In 2021, Congress passed the Corporate Transparency Act. This law creates a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures. What this may mean for you as a small business or business owner is increased reporting requirements and the risk of hefty fines for non-compliance.

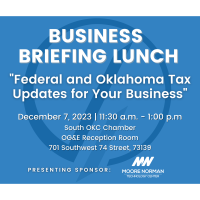

Thursday Dec 7, 2023

December 7, 2023 South Oklahoma City Chamber of Commerce $10 for members

Elizabeth Fox at (405) 634-1436 or ElizabethFox@southokc.com

Phillip Murphy EA of Murphy Tax Associates LLC will be sharing important information about the Corporate Transparency Act as well as some insights on some of the other Federal and Oklahoma tax updates which may impact businesses and small business owners. This will include the latest updates on the Employee Retention Credit and discussion of Oklahoma’s new Parental Choice Tax Credit.

Presenting Sponsor: Moore Norman Technology Center

Gold Sponsor: Oklahoma City Community College

Date and Time

11:30 AM - 1:00 PM CST

11:30 a.m. - 1:00 p.m.Location

OG&E Reception Room

701 Southwest 74 Street, 73139Fees/Admission

$20 for non members

RSVP by December 5.

*Since lunch will be provided, if you RSVP to come and do not show, you will still be charged the $10 registration free.Contact Information